Dumping on American Builders and Homebuyers

As we at Cato frequently explain, “trade remedies” tariffs — antidumping, countervailing duty, and safeguard actions — are one of U.S. trade policy’s dirty little secrets. They’re insanely (and intentionally) complex, buried in layers of regulatory mumbo‐jumbo, and thus mostly ignored by politicians, media, and laypeople who often claim or believe that the United States is some sort of bastion of “unfettered free trade” (or whatever). Yet trade remedy measures here are numerous — there are 659 AD/CVD orders in place today (almost doubling since 2016) — and constitute significant, long-lasting restrictions on imports of essential goods into the United States. By raising the domestic prices of hundreds of products that American companies and consumers need, trade remedies impose significant harms on the U.S. economy — harms that go unnoticed by the general public, except in rare circumstances.

Among those circumstances is when trade remedy measures happen to affect a product or issue that Americans, and the American media, care deeply about. With that in mind, Cato last year commissioned a paper from academic economists Alessandro Barattieri and Matteo Cacciatore to examine how U.S. trade remedy measures on key construction materials — inputs used by American companies to build homes, office buildings, and everything in between — affect the prices of those materials and, by extension, how U.S. trade policy likely affects prices of new homes in the United States. The new paper would build on their excellent work in a 2020 National Bureau of Economic Research paper showing how trade remedies affect imports of industrial inputs and the U.S. manufacturers that consume them. (You can read my short review of the paper here.)

The economists’ latest results, published today in a new Cato Briefing Paper (“American Protectionism and Construction Materials Costs”), are striking and have significant implications for U.S. trade, construction, and housing policy. After first noting the substantial recent increase in both U.S. construction materials prices and home prices (see Figure 1 below), they gather data on the most significant U.S. trade remedy measures affecting the domestic construction materials sector.

These data are summarized in Table 1 below, which shows the most important industries receiving trade remedies protection among the construction sector’s material suppliers; the share of imports subject to new trade remedies measures; and the level of duties applied to subject imports. The eight industries listed in column 1 account for approximately 25 percent of the U.S. construction sector’s intermediate inputs, and, as you can see in column 3, applied duty rates in these cases are substantial (ranging from 28 to 134 percent). Unsurprisingly, the largest share of imports covered by U.S. trade remedy measures is in the “sawmills and wood preservation” industry (almost 82 percent of all imports — see columns 4 and 5), which is surely driven by the current duties on Canadian lumber. However, the data also show that (as I’ve covered previously) U.S. trade remedy measures cover all sorts of other products — pipes, nails, cabinets, wood flooring, plywood, sinks, shelving units, etc. — that American builders use every day.

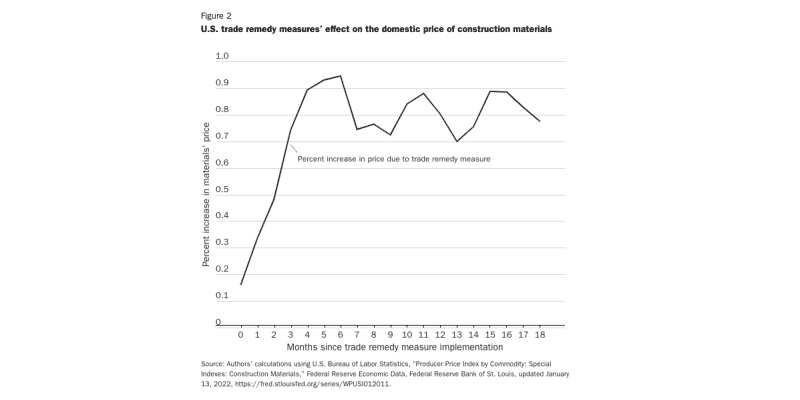

Barattieri and Cacciatore next use these data, along with data from the Federal Reserve’s monthly producer price index for construction materials, to determine how the former affect the latter, accounting for other factors potentially affecting the construction sector. They then estimate how much an increase in U.S. trade remedies actions affects construction materials prices in subsequent months, and as shown in Figure 2, find that a U.S. trade remedy action causes domestic construction material prices to increase significantly up to 18 months after the measure’s implementation. In particular, they find that “a uniform 1 percentage point increase in the share of construction material imports into the United States that are subject to new trade remedies (corresponding to a 1.35 percentage point uniform import tariff) increases the domestic price of those materials by 0.9 percent after six months.” They check their results using an alternate dataset — the Federal Reserve’s price index of net inputs to residential construction — and obtain similar results (see Figure 3).

The authors’ conclusions are worth quoting in full:

Tariffs imposed by the U.S. government on materials used by the domestic construction sector cause a significant increase in the cost of those goods. These results suggest that lifting trade restrictions on intermediate inputs could help dampen recent increases in U.S. construction material costs. Addressing the ultimate impact of these trade barriers on skyrocketing U.S. housing prices is beyond the scope of this paper. Nevertheless, U.S. homebuilders report that they often pass on higher material costs to homebuyers, and previous research notes that many homes in the United States are priced close to their construction cost, of which materials (e.g., lumber) are a significant part. Our results therefore suggest that U.S. trade barriers affect home prices, at least in certain areas, and that this connection is an important avenue for future analysis and research.

As we’ve often discussed here at Cato, there is no “quick fix” to the U.S. trade remedies system, which is rife with abuse and causes numerous economic, foreign policy, and domestic political problems, yet has been intentionally designed by Congress to ignore consumer or broader national interests. A lasting, legislative solution is therefore required. Hopefully, the findings in this new paper — and others like it — will help to generate new support for such obvious and necessary changes to U.S. law.

You can read the full text of the new paper, including its detailed methodology, here.

To read the original post by Cato Institute, click here